AR AR-3Q-TEX 2011-2024 free printable template

Show details

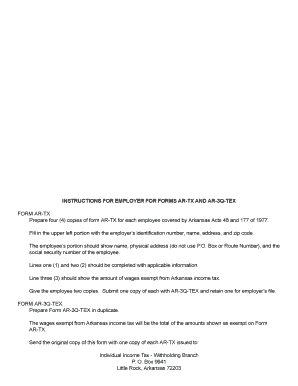

Select either Texarkana Arkansas or Texarkana Texas resident and whether the employee is a complete year resident of Texarkana. Enter the exempt wages. Give the employee two copies. Submit the State Copy of AR-TX with AR-3Q-TEX to Withholding Tax and retain one copy for employer s file. Due date for filing for AR-3Q-TEX and the State Copy of form AR-TX is February 28th of the following tax year. FORM AR-3Q-TEX State of Arkansas Annual Reconciliat...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form ar tx 2023 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form ar tx 2023 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form ar tx 2023 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ar tx form 2023. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out form ar tx 2023

01

To fill out form ar tx, begin by obtaining the form itself. You can usually find it online on the official website of the organization or agency that requires it. Alternatively, you may visit their physical office to obtain a hard copy of the form.

02

Carefully read the instructions provided on the form. This will help you understand the purpose of the form and the information that needs to be provided.

03

Start filling out the form by entering your personal information accurately. This may include your full name, address, contact details, and any other required identification information.

04

Pay attention to any sections that require specific details or documents. Some forms may require you to attach supporting documents such as identification, proof of address, or other relevant paperwork. Make sure to gather these documents beforehand and submit them along with the completed form.

05

If there are any questions or sections that you are unsure about, it is recommended to seek clarification from the issuing organization or agency. They will be able to guide you on how to accurately complete those sections.

06

Double-check your entries for any errors or omissions. It is important to review the filled-out form thoroughly to ensure accuracy. Mistakes or missing information could result in delays or even rejection of the form.

07

Once you are confident that the form is accurately filled out, sign and date it as required. This signifies your agreement to the information provided and the authenticity of the form.

08

Keep a copy of the completed form for your records before submitting it. This will serve as proof of your submission and may be required for future reference.

Who needs form ar tx?

01

Form ar tx is typically required by individuals or businesses that engage in certain financial transactions or reporting requirements. This form may be necessary for tax purposes, financial audits, or regulatory compliance.

02

Certain professionals, such as accountants, tax consultants, or financial advisors, may also need form ar tx to assist their clients in fulfilling their legal or financial obligations.

03

The specific individuals or organizations that need form ar tx may vary depending on the jurisdiction and the specific requirements imposed by relevant authorities or governing bodies.

Overall, anyone who is required to report financial information or engage in specific financial transactions should determine whether they need to fill out form ar tx based on the applicable guidelines and regulations. It is advisable to consult with professionals or the relevant authorities to ensure compliance.

Fill fillable ar tx form : Try Risk Free

People Also Ask about form ar tx 2023

What is the border city exemption?

Does Arkansas have a state income tax form?

Do I have to file an Arkansas state tax return?

Do I have to pay Arkansas taxes if I live in Texas?

Where can I get an Arkansas state tax form?

What is an AR TX form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form ar tx?

Form AR TX is a form used by the Texas State Comptroller to collect information about a business's taxable sales and purchases. It is used for filing sales and use tax returns in Texas.

Who is required to file form ar tx?

The Texas Comptroller of Public Accounts requires businesses with taxable activities in Texas to file Form AR-Texas. This includes sole proprietorships, partnerships, corporations, and limited liability companies (LLCs).

How to fill out form ar tx?

To fill out an AR-Tx form, you will need to provide your name, address, date of birth, Social Security Number, and contact information. You will then need to answer questions about your income, assets, liabilities, and expenses. This form is used to determine your eligibility for various types of assistance programs such as Medicaid, SNAP, and TANF. In addition to filling out the form, you may need to submit additional documentation related to your income and expenses.

What is the purpose of form ar tx?

Form AR TX is a form used by the Texas Comptroller of Public Accounts to report and pay Texas franchise tax. It is used to calculate and report the total amount of franchise taxes due.

When is the deadline to file form ar tx in 2023?

The specific deadline to file form AR TX in 2023 is April 15, 2023.

What is the penalty for the late filing of form ar tx?

The penalty for the late filing of form AR TX is a $50 fee for each return or report that is not filed on time. Additionally, the Texas Comptroller may impose a penalty of up to 10% of the tax due, with a maximum penalty of $50,000.

What information must be reported on form ar tx?

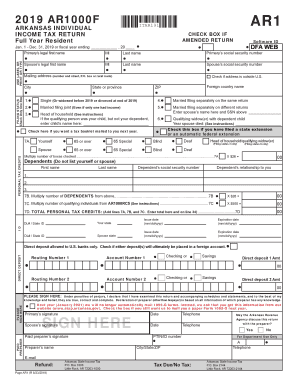

Form AR TX is not a specific form that exists. However, if you are referring to the forms that need to be filed for Arkansas state taxes, the specific information required may vary depending on the form you are referring to. Here are some common types of Arkansas tax forms and the information typically required:

1. Form AR1000: Individual Income Tax Return

- Personal information (name, social security number, address, etc.)

- Income sources and amounts (wages, salaries, interest, dividends, etc.)

- Deductions and exemptions

- Tax credits

- Withholding information

- Calculation of taxes owed or refund due

2. Form AR3MAR: Military Retirement Exemption Application

- Personal information

- Military retirement income sources and amounts

- Calculation of military retirement exemption

3. Form AR1000NR: Non-Resident Individual Income Tax Return

- Personal information

- Income sources and amounts earned in Arkansas

- Allocation and calculation of Arkansas tax liability for non-residents

4. Form AR4EC: Extension of Time to File

- Personal information

- Reason for extending the filing deadline

These are just a few examples, and there are several other forms specific to various tax situations. It is important to consult the official Arkansas Department of Finance and Administration website or seek professional tax advice for accurate and up-to-date information on form requirements and reporting obligations.

How can I send form ar tx 2023 to be eSigned by others?

To distribute your ar tx form 2023, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the form ar tx in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your ar 3q tex in seconds.

How can I fill out download form ar tx on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your ar tx form 2020. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your form ar tx 2023 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ar Tx is not the form you're looking for?Search for another form here.

Keywords relevant to texarkana arkansas tax exemption form

Related to state of arkansas form ar 3q tex

If you believe that this page should be taken down, please follow our DMCA take down process

here

.